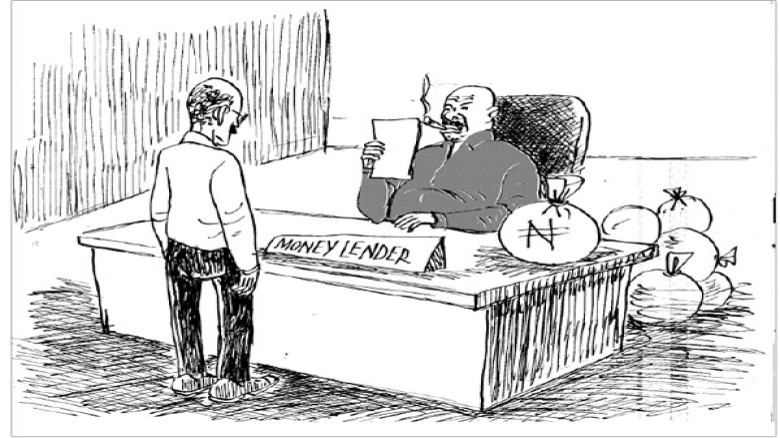

Nigerians borrow N3.9tn as economic crisis bites harder

Nigerians burdened by rising living costs got loan facilities totaling N3.82 trillion from banks as of January 2024, according to the Central Bank of Nigeria.According to the latest monthly economic data posted on its website, overall consumer credit increased by 11.9 percent to N3.82 trillion in January 2024, driven mostly by an increase in personal loans as inflation soared.

On a year-over-year basis, the amount increased by N1.41 trillion from N2.41 trillion recorded in January 2023.

Personal loans surged by 14.3 percent to N3.028 trillion from N2.648 trillion in December 2023, while retail loans jumped by 3.6% to N794.79 billion.

Personal loans accounted for 79.2 percent of consumer credit, while retail loans accounted for 20.8%, showing Nigerians' struggle with persistent inflation and declining purchasing power.

According to the report, "Total consumer credit outstanding increased by 11.9 percent to N3.82 trillion in January 2024, driven primarily by an increase in personal loans as inflation rose." A breakdown of consumer credit showed that personal loans jumped by 14.3 percent to N3.028 trillion from N2.648 trillion in December 2023, while retail loans increased by 3.6% to N794.79 billion. Personal loans accounted for 79.2% of total consumer credit, with retail loans accounting for 20.8%. Consumer credit, as a share of overall credit from ODCs, fell to 6.6 percent from 7.7 percent the previous month.

The apex bank also claimed that overall credit given to important sectors of the economy climbed by N13.22 billion, or 29.7 percent, to N57.76 billion, compared to N44.54 billion in the previous month.

"Total credit extended to major sectors of the economy by other depository corporations climbed by 29.7 percent to N57.76 billion, compared to N44.536 billion the previous month. The continued expansion in lending to services (25.6%), industry (37.5%), and agriculture (7.1%) fueled the growth. A breakdown of sectoral credit revealed that the services sector remained dominating, accounting for 52.1%. According to the report, industry accounted for 44.7%, with agriculture accounting for the remaining 3.2%.

The headline inflation rate reached a 28-year high of 33.95 percent in May, prompting the central bank to raise interest rates consecutively to 26.25 percent.

Nigerians are facing declining living standards and rising economic problems as a result of the present administration's adoption of broad economic reforms.

As a result, the country is experiencing its greatest economic crisis in decades, with surging inflation, a plummeting national currency, and millions of people unable to purchase food.

This circumstance has forced many residents to seek loans in order to cover their fundamental demands.

According to a study conducted by SBM Intelligence, 27% of Nigerians from various income categories are now using loan applications to cover their living expenditures in the wake of record inflation.

The spike in demand for these lending apps demonstrates the devastating impact of persistent inflationary pressures on Nigerians' daily lives, particularly those already struggling with low financial means.

While residents in the informal sector use lending apps, civil servants rely on their employers for assistance.

Meanwhile, public employees received N6.1 billion in credit from their respective state governments within 15 months, despite worsening economic conditions.

According to a study of their budget implementation report released from the Open States website, civil servants borrowed in the form of loans and salary advances between January 2023 and March 2024.

Further investigation revealed that the workers received loans from 11 states to purchase automobiles and construct homes and furniture.

Our reporter also discovered that most states did not award loans to their employees despite budgetary allocations. An annual budget breakdown revealed that civil servants in Delta State received the largest loan of N2.75 billion, followed by Kano State with N1.1 billion and Kebbi State with N680 million.

Yobe State is fourth on the list, with salary advancements valued N586.88 million.

Other states that lent money include Lagos State (N294.44 million), Jigawa (N244.58 million), Enugu (N401.94 million), Anambra (N427,200), Borno (N428,000), Kwara (N44.13 million), and Ogun.

Loan company founders have argued that tough economic realities have caused more people to rely on loans as the cost of goods and services has risen, particularly since the withdrawal of gasoline subsidies.

In an interview with The Nigeerianwatch, Adeshina Adewumi, Chief Executive Officer/Founder of Trade Lenda, stated that his company's absolute numbers had increased by 100% in recent years.

He said, "The numbers have gotten quite high." In terms of users, we have expanded somewhat more than 100% throughout the subsidy elimination period of June and July.

"Despite the fact that we do not focus on individuals, there has been a rise in loans overall. We only work with firms who need financing to expand, and we've witnessed a huge increase in the number of applications. We have increased by more than 100% in the last two months. People are seeking N50,000 (the lowest we have seen) and as much as N5 million."

Olajuwon Marc, the founder of TellerOne, said that the number of loans issued by his company had increased.

He added that the economy has recently hampered firms, and the only way for them to expand was to borrow more money.

He stated, "Things are now very expensive, and the original money that firms have is no longer enough to acquire things from the market, so they now rely on loans to exist. We grant these loans to small and medium-sized enterprises."

He continued, "The number of authorised loans has increased to up to 70%. The demand has risen to more than 100%. People always need loans, and the current economic circumstances are pushing this."

While lending apps provide some relief to small businesses, there are still numerous difficulties that only significant government action can address.

Leave A Comment